Mission and History

Our Mission

Our mission is to provide convenient, cost effective financial services by offering products that are efficient and responsive to our members’ changing needs.

In keeping with the credit union philosophy of “people helping people,” we seek to educate members to make better financial decisions.

Our commitment is to operate in a financially sound manner with a staff dedicated to excellence.’

How We Implement It

Our members have access to competitive loan rates and excellent yields on savings. They are able to manage their family’s finances from four branches, any computer, tablet, or phone, and a large network of surcharge-free ATMs. They have all the conveniences they demand, from debit cards to on-line loan applications, direct deposit, and more.

In addition to Bowater Credit Union’s ever-growing services and products, we have partnered with Bowater Wealth Management to provide more options to help our members plan better financially. Our job as a credit union is to offer reasonable loans and encourage saving for the future.

With over 70 years of experience in the financial industry, our members know they are owners of an exceptional, family-oriented institution.

Our History

For those who don’t know, credit unions are a lot like banks. They offer savings, checking, and loans. But credit unions have a distinct trait: they are not for profit. They exist only to serve the membership. In fact, the first credit unions began in Europe and were known as “People’s Banks.” The concept was a simple one, that people with a common interest could pool their funds and make loans to those in the group who were in need.

That’s exactly what eight men at Bowaters Southern Paper Corporation decided to do in 1954. Those eight men were Geo R. Koons, C. E. Opdyke, Denis W. Timmis, R. B. Reid, S. H. Jammes, M. J. Osborne, Otha Winningham and R. R. Edgar. The purpose of Bowater Credit Union was set forth in the original bylaws and has not changed in 60 years:

- To promote thrift

- To make loans to its members at reasonable rates of interest for provident purposes

- To invest any surplus not required for loans to members in the way and manner by law provided

- To exercise those functions described in the State of TN authorizing the organization of Credit Unions

- Membership in the newly formed credit union included all employees of Bowaters Southern Paper Corporation of Calhoun, TN and their families.

Additional dates of interest:

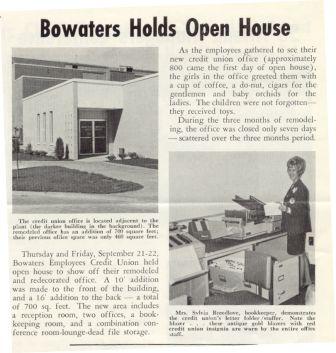

- 1977 – Built an addition to the existing credit union office within the paper mill.

- 1987 – Name changed from “Bowaters Employees’ Credit Union” to “Bowater Credit Union” to reflect an effort to merge with the City of Cleveland Employees Credit Union. The membership rejected this merger.

- 1988 – Extended family of current members made eligible

- 1989 – Name changed from “Bowater Credit Union” to “Bowater Employees Credit Union”

- 1990 – Office moved from inside the paper mill to a separate building “on the hill” of the paper mill’s property.

- Early 1990s – The credit union grew as more people felt they were a part of the Bowater community and could use Bowater Credit Union’s services. The Credit Union Board of Directors saw safety in diversification and in the early 90s, residents of Calhoun and Charleston were granted eligibility and began using Bowater Credit Union.

- 2001 – Employees of Denso Manufacturing were on the hunt for a local credit union that could serve its employees well. They found Bowater Credit Union to have the services they were looking for and a philosophy that matched their ideals, but their employees weren’t eligible to join. After proper regulatory approval, all Denso employees and their family members became eligible to join Bowater Credit Union.

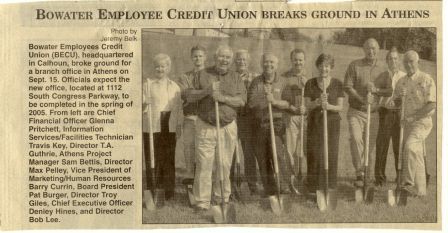

- 2005 – Opened Athens Branch. Soon more local companies requested the opportunity to make Bowater Credit Union part of their employee benefits package. From Woods Memorial Hospital to the City of Cleveland, companies throughout our community were clamoring for membership.

- 2005 – Placed a 24-hour deposit-taking ATM in Etowah, across from Woods Memorial Hospital.

- 2008 – Opened Cleveland Branch.

- 2009 – After America’s financial system collapsed in 2008, credit unions became more visible as a safe, government-insured option for financial services. It no longer made sense to turn residents and employees of this community away from Bowater Credit Union just because they didn’t work for a specific company. So, in 2009 the State of Tennessee granted Bowater Credit Union’s request to become a community credit union. Everyone who lives and works in our 5-county area is eligible for membership in Bowater Credit Union. Employees of Partner Companies get special benefits and access to financial education as an employee benefit.

- 2010 – Opened the South Cleveland 24-Hour deposit taking ATM on King St.

- 2010 – Merged with Electrical Products Employees Federal Credit Union. EPEFCU served employees of Thomas & Betts in Athens, TN. Bowater Credit Union happily welcomed the members and employees of Thomas & Betts into their new credit union.

- 2014, Sept – The Loan Zone located in Cleveland at 1040 King Street, off APD-40, opened

- 2014, Oct – Merged with Members First Credit Union in Cleveland, TN. Members First served employees of CPQ Professional Imaging and The Portrait Café, Hardwick Clothes, Brown Stove, Advance Photographic Solutions, Newell Rubbermaid, and Universal Assemblies.

- 2015, Oct – The Calhoun Main Office relocated from “up on the hill” to the corner of Bowater Road and Highway 11 S.